It happens all the time in the Old Masters market, but I could never understand how a work of art could sell at auction for one price, only to reappear–and to sell–at a fair a few months later with a vastly inflated price tag. I mean, I can imagine how a dealer would do it; and if there were a cleaning, a restoration, a different presentation, or even new research or a new attribution, it can even make sense. What I don’t get is the mindset of the collector who, either through indifference or ignorance, buys a work that just sold very publicly for 40-80% less than what he paid.

Of course, it would explain a lot if these chumps are all North Korean 80’s art speculators. Let’s pick at some of the confusing details from the New York Law Journal’s error-ridden story of an unsuccessful lawsuit by one such “collector,” Najung Seung, who the NYLJ describes as “a resident of North Korea” and “a woman who worked in art galleries in Beijing.”

In May 2006, Seung, and who is actually listed in court filings as Korean, not North Korean, bought a 1986 John Wesley painting for $118,000 from Dinaburg Arts, a NY art advisory. Its principal, Mary Dinaburg, had just curated Wesley into the windows of the Hermes store, and Seung was friends with one of Dinaburg’s assistants.

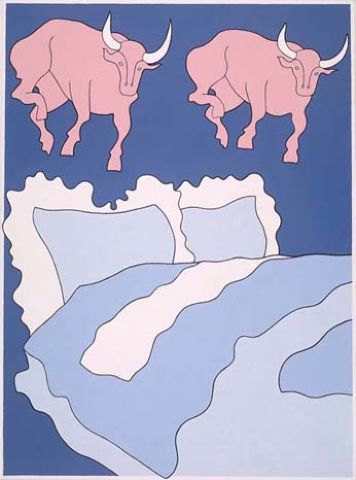

But despite holding a paid invoice for Bulls and Bed, “the following March [i.e., 2007], Seung learned that Dinaburg had sold the Wesley painting to another buyer,” reportedly for $200,000. Way to stay on top of things, Najung. [Bulls and Bed was at Basel this past summer, btw, offered by Wesley’s London representative, Waddington Galleries, for $300,000. It’s still available.]

To make up for it, Dinaburg apparently offered Seung a $200,000 credit toward the purchase of Chinkzee a giant, truly execrable, 1983 velvet painting of a dog by Julian Schnabel. It was a $500,000 painting, Dinaburg said, though she’d let it go at the “gallery net” price of $380,000. In a May 2008 email, Dinaburg wrote, “I believe we have a good opportunity to place your work within the year and resell it a profit.”

Instead of her main firm, though, Dinaburg offered the Schnabel through Fortune Cookie Projects, [not Ventures, NYLJ. Who’s proofing these things?], the Asia-focused art advisory operation she’d launched in 2006 with Howard Rutkowski, who oversaw Asian, modern, and contemporary art for Bonham’s auction house in London.

Seung agreed and paid Fortune Cookie an additional $90,000 in June 2008. Her lawsuit mentions a final invoice [presumably unpaid] for the last $90,000 installment, dated October 30, 2008, aka The End of The Art World As We Knew It.

At some point–even though it kind of matters, it’s not clear when–Seung realized that Chinkzee had sold in May 2007 at Phillips in New York for $156,000, well above its original estimate of $60-80,000, but well below the $500,000 value she’d been told. [How Seung managed to avoid getting those gigantic catalogues Fedexed to her, I have no idea; Phillips was blanketing the globe with those things.]

Anyway, if Seung’s case is meaningful, it’s only as a reminder to collectors to do their own damn homework; the NY Supreme Court determined that art advisors and even dealers are not “experts,” and their opinions are just sales patter which constitutes, at best, “non-actionable ‘puffery’…on which a sophisticated commercial entity could not reasonably rely.”

When I started writing this post, I thought it was just a savvy dealer using the promise of an easy follow-on flip to flip her own auction purchase to a clueless, foreign speculator. But there’s someone else involved. Dinaburg’s emails to Seung, including the one promising “the gallery net,” make it sound like Chinkzee was coming from the artist himself:

(1) We are working with the very well respected [sic] and important [sic] artist Julian Schnabel. I was thinking that I could offer you what I offer the galleries directly…

(3) I have spoken to the Schnabel studio and have gotten the final lowest possible price on both [?] works

(4) I was over there with Julian before I went to Hong Kong and we were pricing work and you will never see a Schnabel form [from] the studio coming out at the prices they are now, but higher.

Did Schnabel buy his own old painting back from Phillips, and then flip them back through Fortune Cookie? Or was Chinkzee just part of Fortune Cookie’s big, 2007 All-Asia Tour of Schnabel’s “best works”? [A: Yes.] There is a punchline here somewhere about sarong-wearing white devils peddling Chinkzees out of the back of a Fortune Cookie van as they drive across China, but I can’t figure it out.

No Money Back for Gallery Worker Who Relied on Estimate of Schnabel Painting’s Value [law.com]

Sept. 2007: Julian Schnabel Presents Best Works in Beijing [china.org.cn]